Today, we are fortunate to present a guest contribution written by Paweł Skrzypczyński, economist at the National Bank of Poland. The views expressed herein are those of the author and should not be attributed to the National Bank of Poland.

We present an update of the jobs-workers gap discussed in previous posts: [1], [2], [3].

Recent BLS releases “The Employment Situation – January 2023” and “Job Openings and Labor Turnover – December 2022” allow us to update the jobs-workers gap and the business cycle indicator based on it. For January 2023 we assume that job openings level declined to 10.7 mn from December 2022 level of 11 mn, which would be in line what high-frequency data by Indeed suggests (https://www.hiringlab.org/data/).

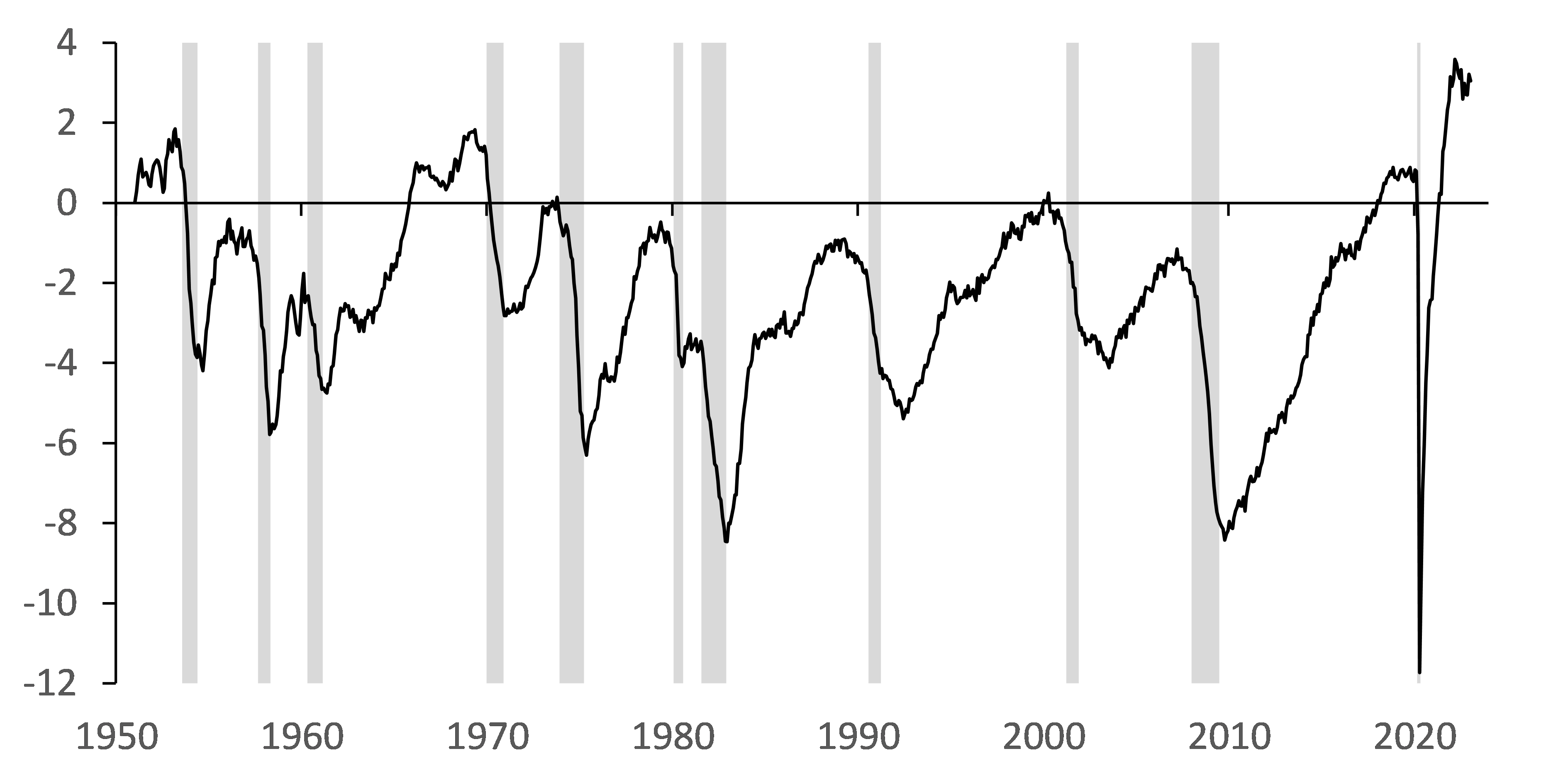

In January 2023 the jobs-workers gap was at 3.0% or 5.0 mn, down from December 2022 by 0.2 pp or 0.3 mn, however December 2022 m/m changes of the gap were 0.5 pp or 0.9 mn, respectively.

Figure 1. Jobs-Workers Gap (Percent)

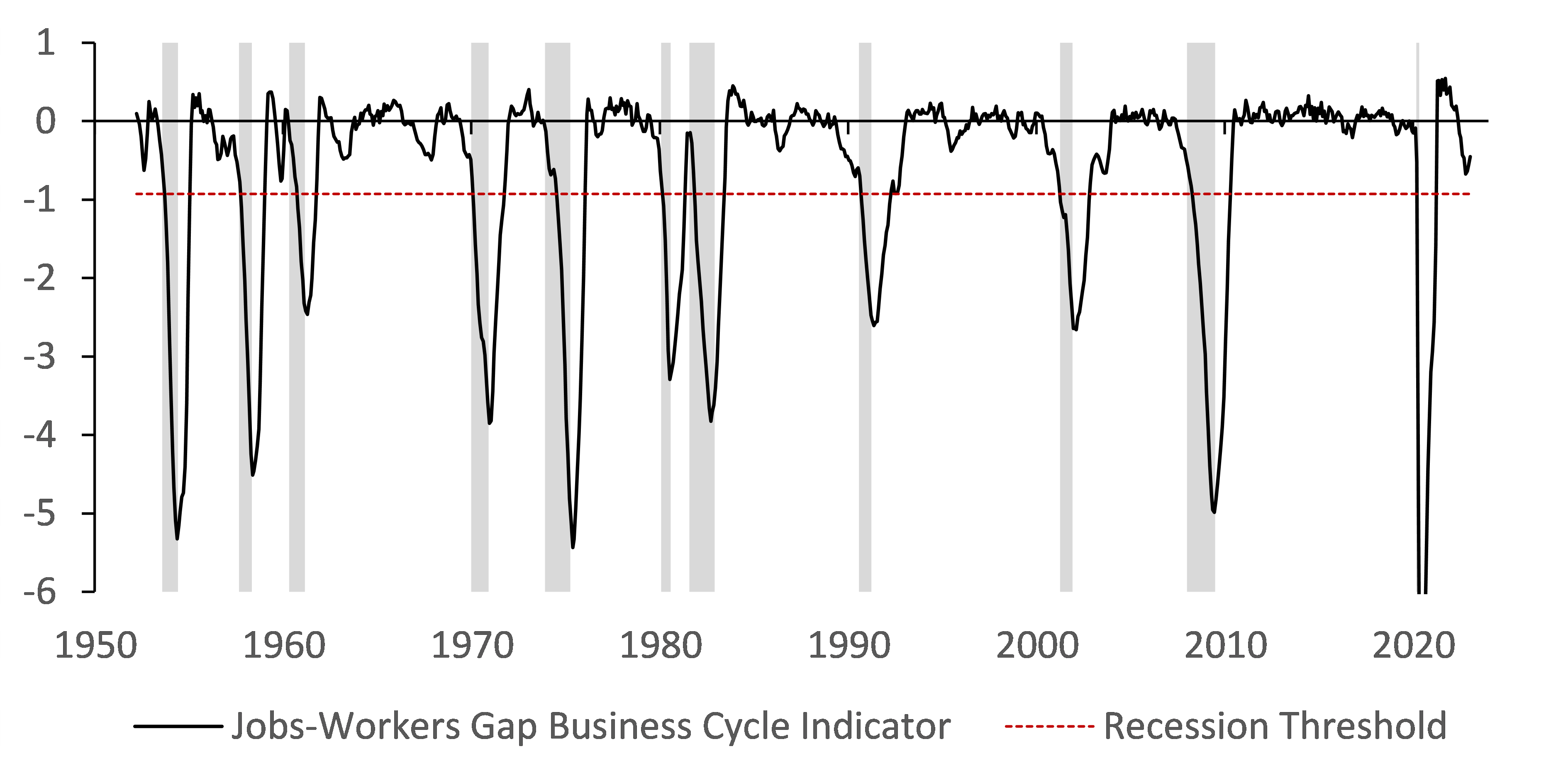

With this new data the jobs-workers gap business cycle indicator (JWGBCI) increased to -0.45 pp in January 2023 from -0.56 pp in December 2022 and -0.64 pp in November 2022, remaining above the recession threshold of -0.93 pp. Recall the indicator uses a smoothed gap, namely we calculate the change of the three-month moving average of the jobs-workers gap relative to its maximum during previous twelve months.

Figure 2. Jobs-Workers Gap Business Cycle Indicator (Percentage Points)

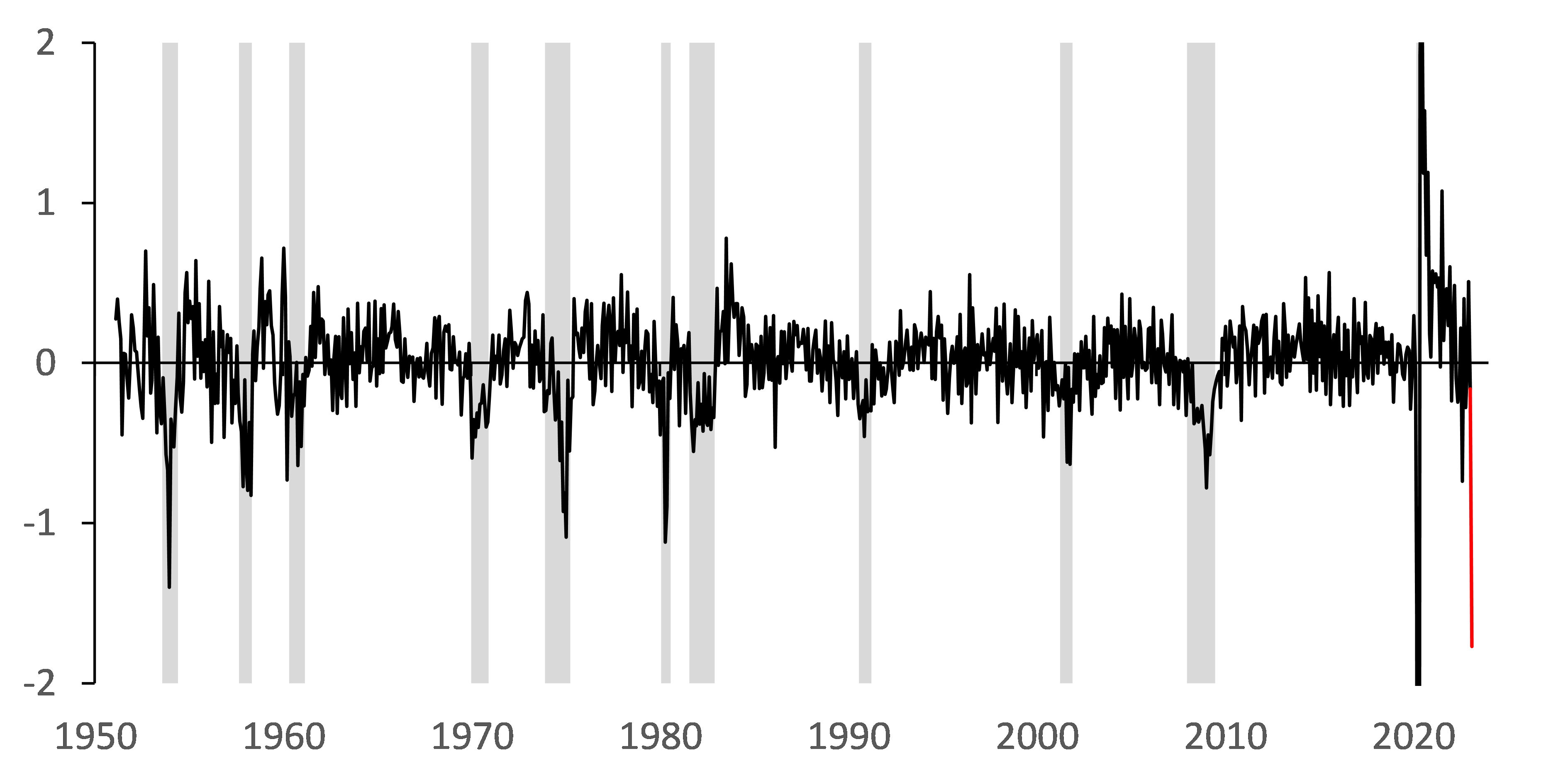

What magnitude of m/m change in the jobs-workers gap would be needed in February 2023 to make a recession call? The jobs-workers gap (not smoothed) would need to collapse to 1.27% from 3.04% in January, that is 1.77 pp which corresponds to 3.7 standard deviations of historical volatility. Figure below presents this change (marked red) in historical perspective. Such a big change seems rather unlikely, as it would most likely mean deep contraction of employment or job openings, or both in m/m terms as of February.

Figure 3. Jobs-Workers Gap 1-Month Change (Percentage Points)

Conclusion of this update remains similar to previous ones. Recent readings of the jobs-workers gap and the business cycle indicator based on it suggest that labor market remains tight and resilient to monetary policy tightening.

This post written by Paweł Skrzypczyński.