Tomorrow is my first full day back at work after a week of leave with family; I am slowly easing myself into my regular routine.

There are so many crosscurrents that I thought a few “food for thought” questions might help the process. These are meaty issues, some of which I hope to address in greater detail in the coming weeks.

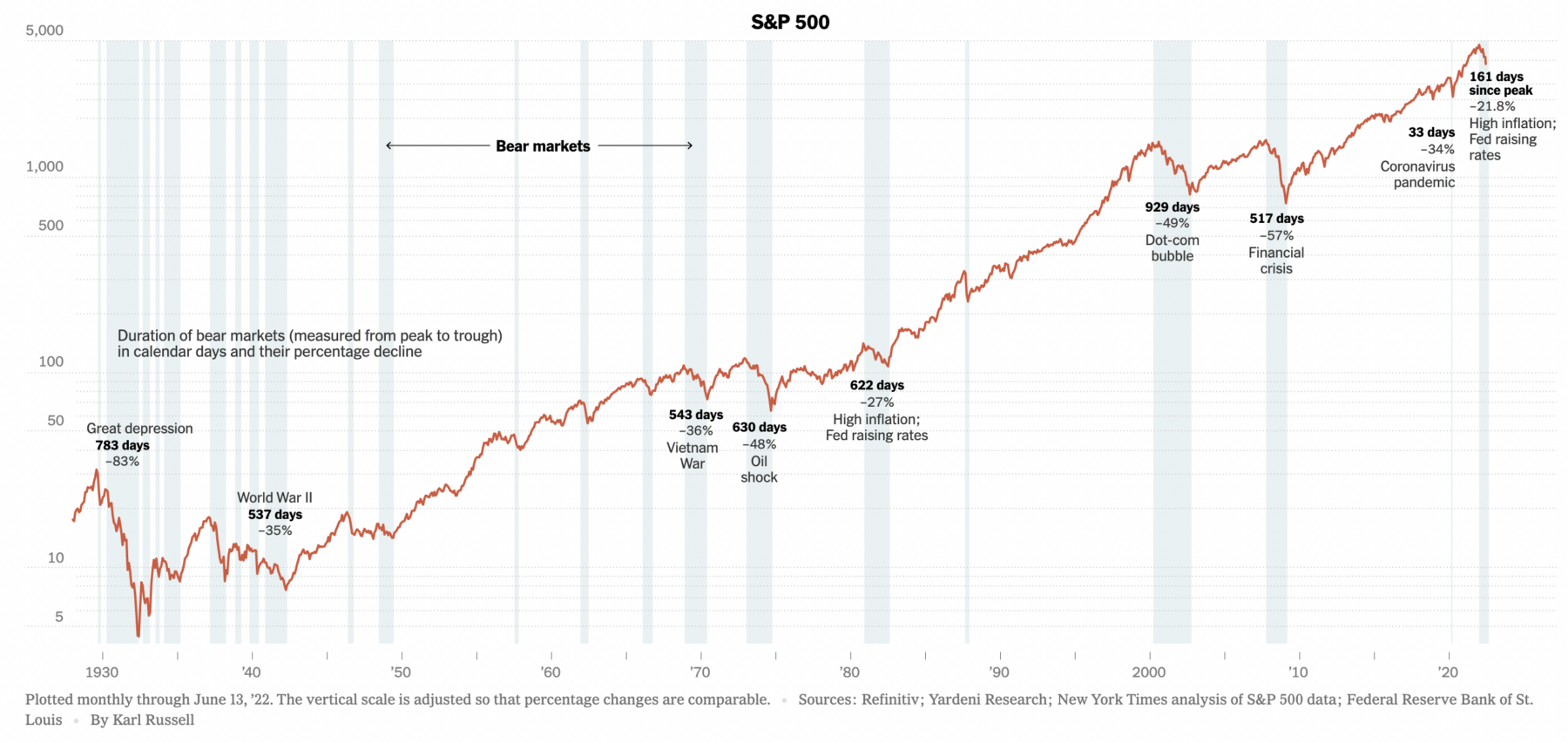

1. Bear Market: Recessions usually see Bear markets accompany them, but not always. The New York Times chart above shows the history of the two. Our first question: Will this Bear bring on a recession?

2. Inflation: Are we near peak inflation? Will the bite on consumers slow consumption, and therefore prices? Does the worlds return to the Deflationary regime anytime soon? Does the FOMC believe inflation is monetarily based? Do they think rates are the driver?

3. Bonds: What are the ramifications of the bond bull market, which began in 1982, ending?

4. Recession: Willt he ecxonomy suffer a growth slowdown or the Fed slow the economy enough to curtail demand-driven inflation without creating a full-on contraction, or is a soft landing possible/probable? Is the FOMC plan simply to slow the economy down enough to crimp demand enough to allow supply chains to normalize?

5. Crypto: Does Crypto present systemic risk? Is this an asset class that will spill over into the rest of the economy, e.g., Housing/Mortgages in the mid-2000s; or. Is this like the collapse of a single 3 trillion-dollar company…

6. Cyclical versus Secular: Will this be a long and drawn-out secular bear market, e.g., 1966-82 or 2000-2013? Or will this be a cyclical bear within a secular bull, e.g., 1998, 2010, 2018?

7. Earnings: Profit growth has been healthy the past decade; can it continue with higher (or perhaps much higher) rates?

8. Retail Sales: Are adjusting to increased supply, but potentially decreased demand. How will the consumer respond to inflation and a general slowing?

9. Housing: Are enough homes being built to balance the demand? How long will he undersupply last? What do 6% mortgage rates do to the demand side of the equation?

10. War/Russian invasion of Ukraine: Will this war end anytime soon, or is this another Afghanistan that will run for years? Will it spill over into Europe? What does this mean for Russia as a nation?

These are the questions I am asking myself. I don’t know the answers, but I will continue to explore all of them…

Previously:

Capitulation Playbook (May 19, 2022)

Secular vs. Cyclical Markets, 2022 (May 16, 2022)

Panic Selling Quantified (March 24, 2022)

Source:

What Happens When Stock Markets Become Bears

By William P. Davis, Karl Russell and Stephen Gandel

New York Times, June 13, 2022