From EconoFact (update of May 2021 version):

Main points:

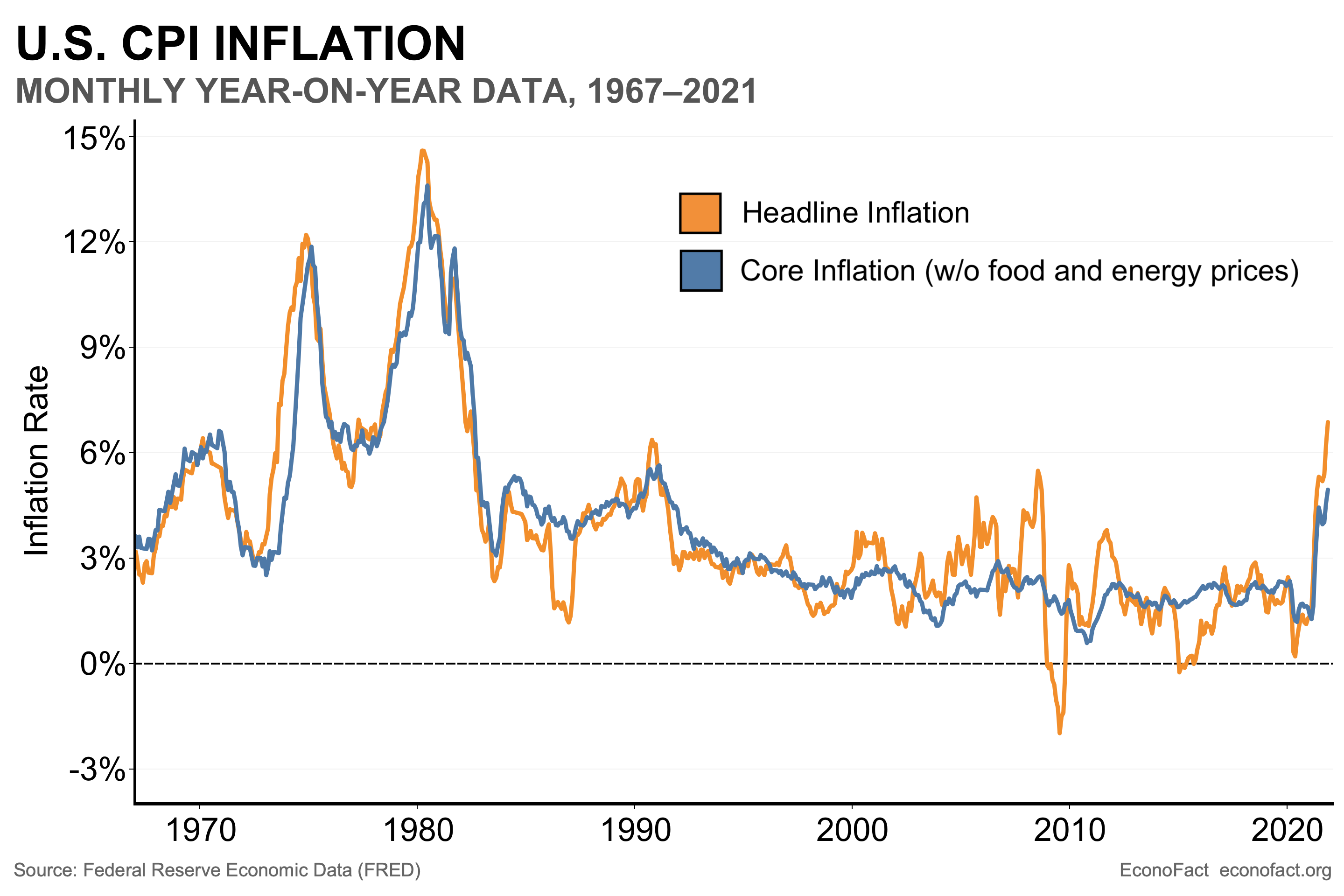

- Prior to the pandemic, inflation had been relatively low for about three decades, and especially quiescent over the past decade.

- Inflation has been rising over the past year, but this comes after especially low inflation in the immediate wake of the onset of the pandemic.

- In order to consider whether inflation is likely to continue at high rates, it is important to look at the different factors that contribute to a generalized rise in prices. Economists’ preferred explanation for inflation, sometimes called the “expectations augmented Phillips curve”, looks to some combination of three factors: slack, expectations, input costs.

- How much slack is there in the economy?

- Economists and households are marking up their expectations of inflation over the next year – although there is a divergence in views between the two groups. While in the relatively longer-term, financial markets project only a slight acceleration in inflation over the next five years.

- Is the cost of inputs likely to continue rising?

- Will labor costs continue to rise?

- Will too much money chasing too few goods cause inflation?

From “What This Means”

Inflation — both actual and expected — matters. Inflation makes it harder for consumers and workers and firms to distinguish between relative and general price changes. It also makes it more difficult to make plans for saving and investment. And, higher expected inflation raises borrowing costs for the government (although higher actual inflation erodes the real value of government debt). Finally, the Fed tends to respond to higher inflation by tightening monetary policy, which depresses economic activity. Hence, the stakes are high for avoiding a sustained acceleration in inflation. So far, inflation has risen in a halting fashion, but remaining more persistently high than previously anticipated. Near term expectations of inflation have risen, but remain relatively muted – particularly amongst economists — either because the anticipated output gap or the responsiveness of inflation to the output gap are thought to be small, longer term inflation expectations remain well-anchored, or all three.

For discussion of expectations, see this post.

For discussion of alternative measures of inflation, see this post.

For discussion of the role of the goods/services distinction, and role of shelter costs, see this post.