“Those who know it best love it least for they have been disappointed the most.”

-Don Coxe 1

One of the more fascinating aspects of the past decade of investing is the ways that Bitcoin and/or Crypto have altered traditional narratives. It created a way for certain groups of people – including those who might otherwise have been gold bugs – to express their ideological beliefs in an asset class.

Recall the mid-2000s during the inflationary Greenspan era, when Gold caught a bid and soared to nearly $2000. It attracted many investors from various philosophies: Hard money advocates, inflation hawks, Federal Reserve critics, Survivalists/End-of-Worlders,2 Anti-government zealots, Libertarians, etc.

By the early 2010s, crypto began attracting many of these same people. Many jokingly referred to crypto as “Millenial Gold.”

By the early 2010s, crypto began attracting many of these same people. Many jokingly referred to crypto as “Millenial Gold.”

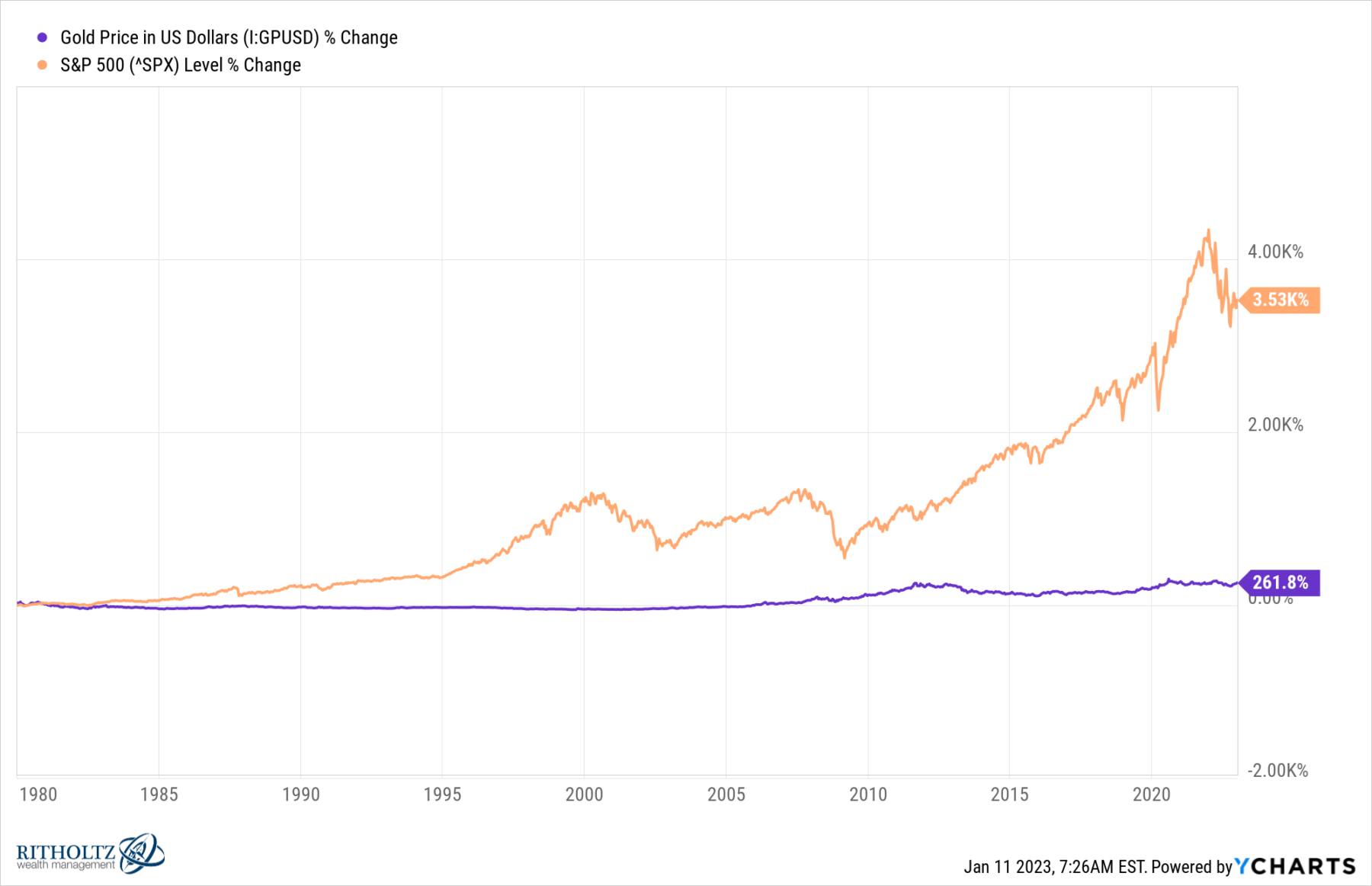

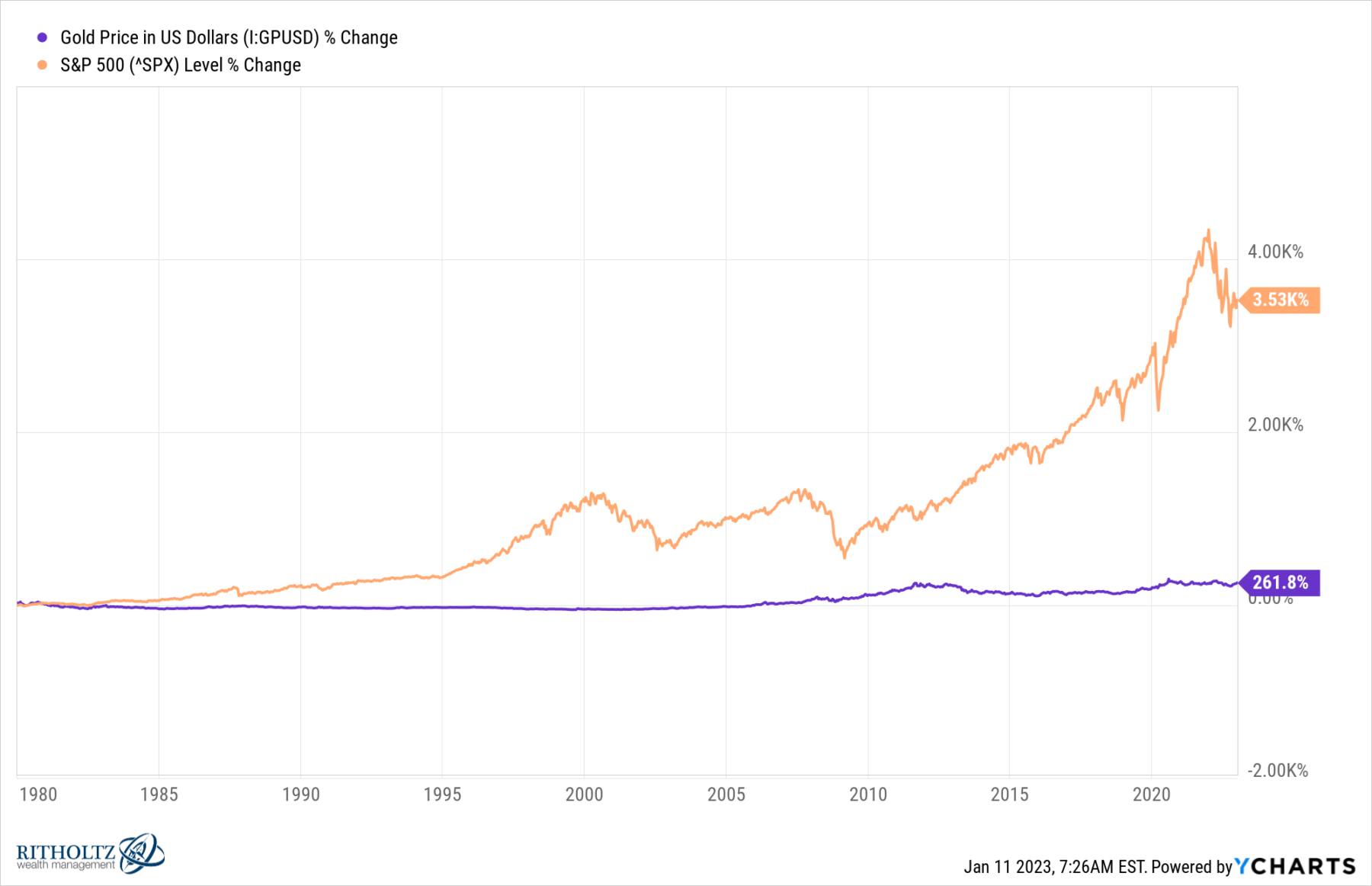

Despite ongoing conditions which should have been supportive of gains in the shiny yellow metal in the past, gold really didn’t make a whole lot of progress. For a few years following the great financial crisis, Gold outperformed the S&P 500 (see 2010-2013). By mid-April 2013, it lost the advantage — and equities never looked back.

I was a fan of gold and the new gold ETF (GLD) back in the mid-2000s. Recommending it on CNBC circa 2005 literally generated laughs from the anchors. It peaked (in dollar terms) around 2011; it made a new high during the pandemic in 2020. We briefly owned it in 2020-21, when conditions looked like they should be supportive of advances in Gold, but it mostly went nowhere.

Last year, I mentioned that Gold was catching a bid, and that seems to be continuing. It makes you wonder if all of those who abandoned Gold for Crypto in the 2010s are returning to the metal post the FTX/SBF collapse.

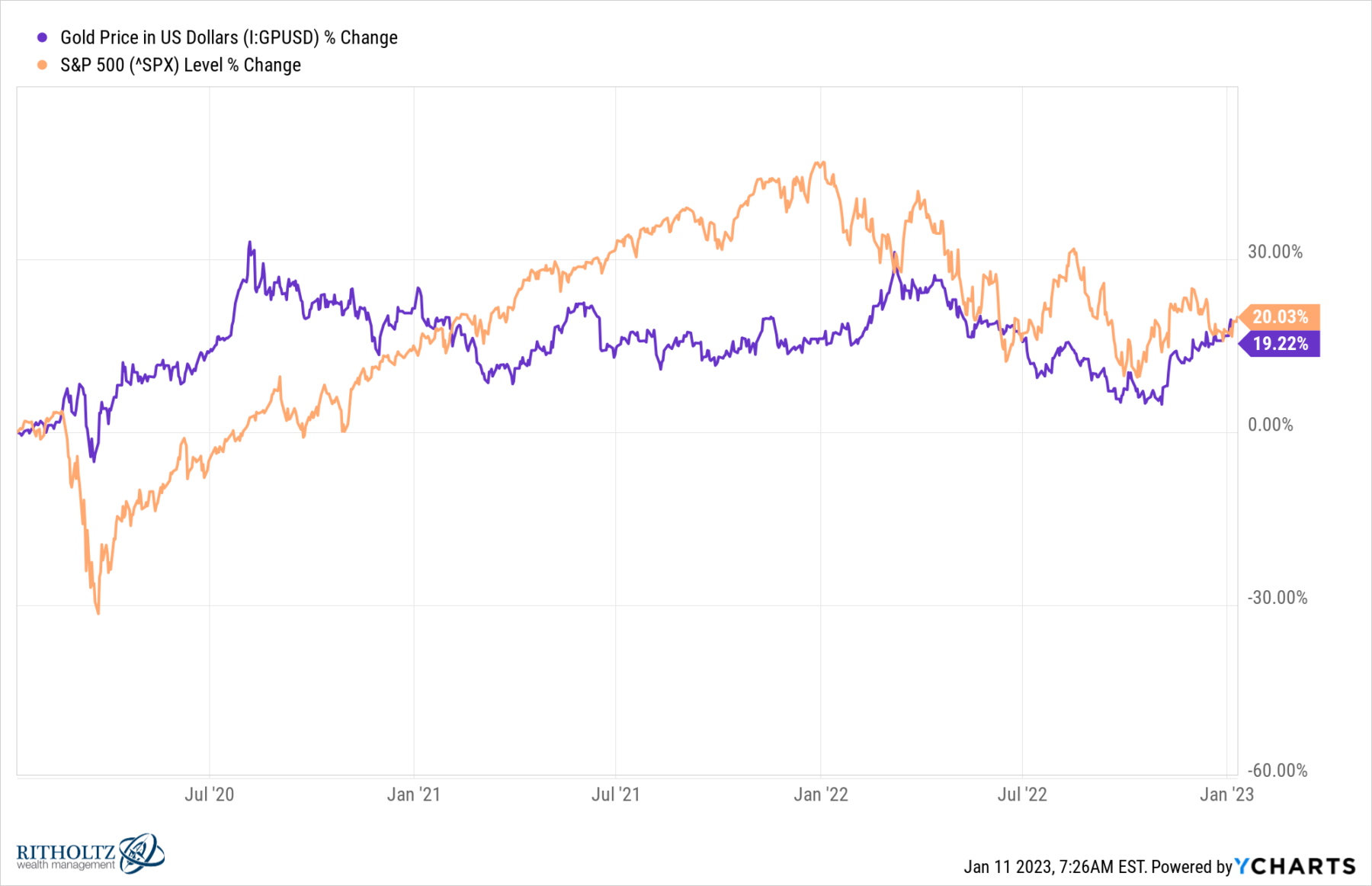

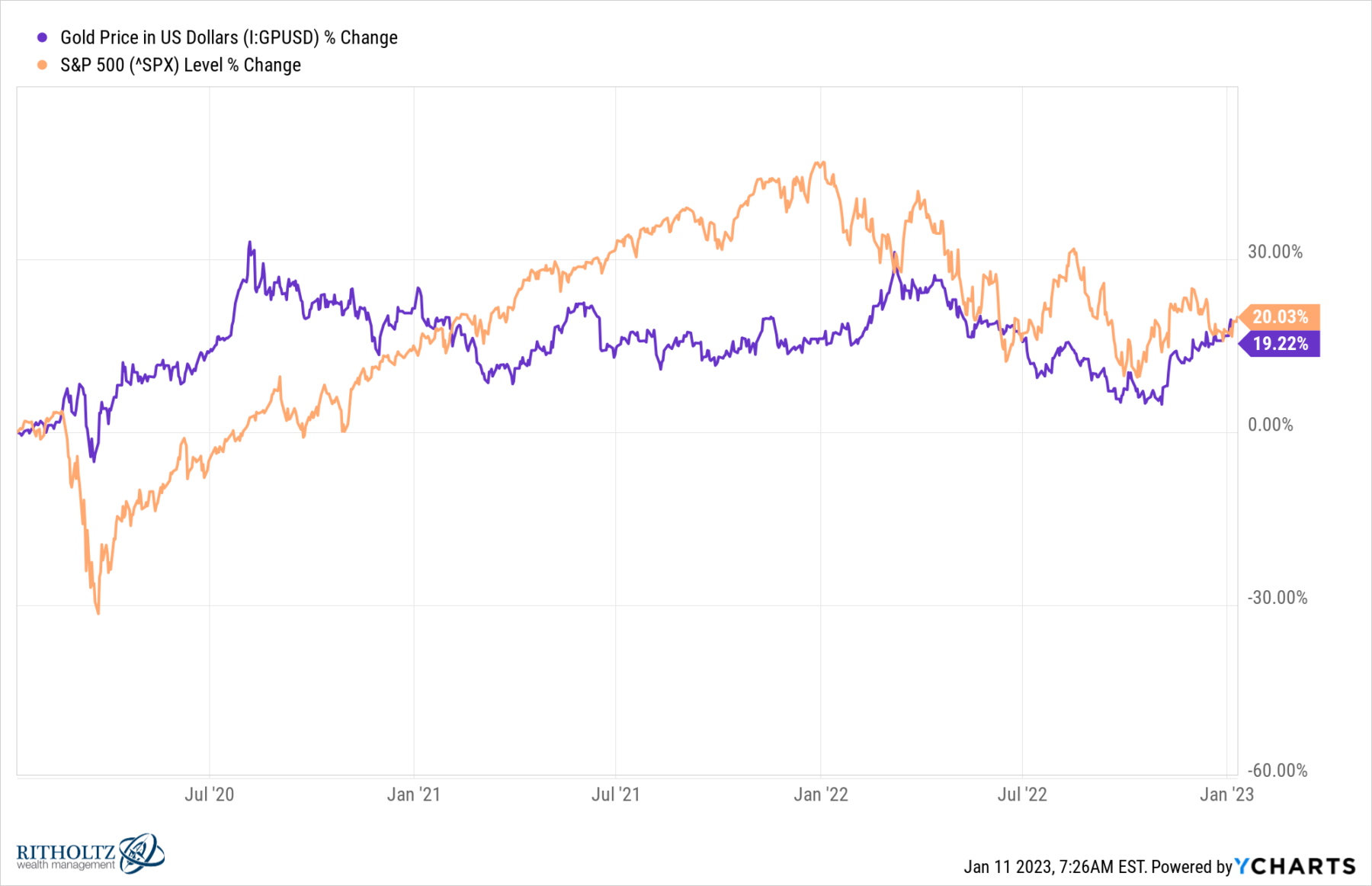

When we look at Gold today, it has been outperforming equities over the past 12 months gaining 4% versus SPX’s 16% loss. However, it is breakeven over 3 years, and on a longer timeline, it lags, often dramatically. This reinforces my general bias that gold is a trading vehicle and not an investment vehicle.

Despite Accommodative Monetary Conditions and Inflation, Gold Lags S&P500 over 3 Years

Since 1980, Equities Have Demolished Gold

If you want to trade Gold, go right ahead. If you want to put it into a portfolio and forget about it for a few decades, you are probably making a mistake.

Check back around 2040 for my next Gold update.

Previously:

12 Rules of Goldbuggery (April 16, 2013)

Bitten by the gold bug? You’ll do well to heed the past (January 12, 2014)

Once Again, the Gold Narrative Fails (December 2, 2014)

10 Lessons Learned from Gold’s Epic Rise & Fall (January 8, 2014)

Gold & DeFi: A Conversation (September 10, 2021)

________

1. The full Don Coxe quote actually means the opposite:

“The most exciting returns are to be had from an asset class where those who know it best, love it least, because they have been hurt the most.”

2. Okay, perhaps not the Survivalists, as crypto requires a functioning infrastructure and robust internet to operate efficiently.