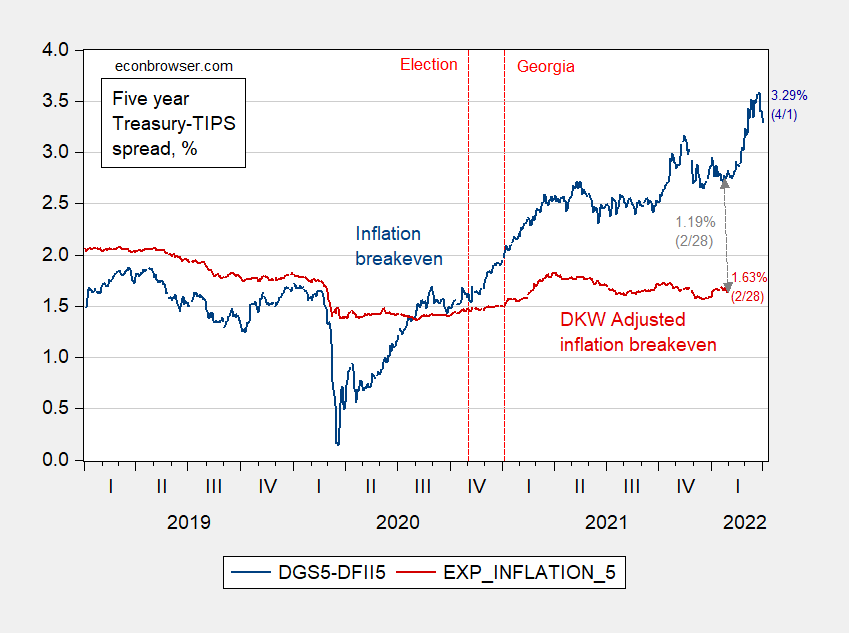

Market expectations for inflation over next five years as of today:

Figure 1: Five year inflation breakeven calculated using 5 year Treasury minus 5 year TIPS yields (blue), five year expected inflation (red). Source: Treasury via FRED, Kim, Walsh and Wei (2019) following D’amico, Kim and Wei (DKW) accessed 3/10/2022, and author’s calculations.

Taken literally, average expected inflation over the next five years is coming down. Notice the gap between simple breakeven and premia adjusted spread (hence expected inflation) was 1.19 percentage points at end-February. If that gap were to hold (no reason it should) through today, then expected inflation would be 2.1%.

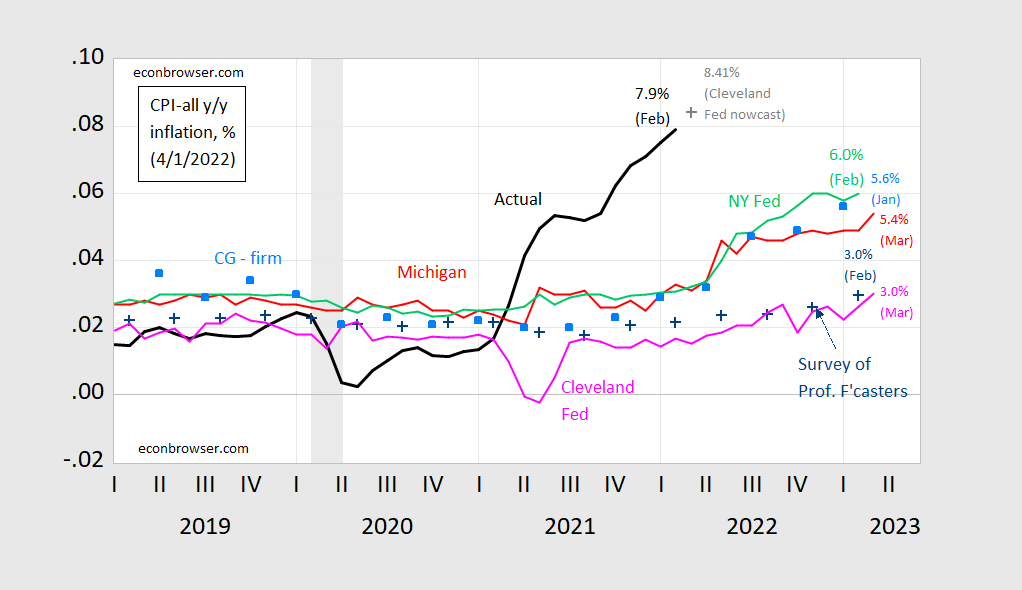

Here is survey based and hybrid estimated forecasts of inflation over the next year:

Figure 2: CPI inflation year-on-year (black), Cleveland Fed nowcast as of 4/1 (gray +), median expected from Survey of Professional Forecasters (blue +), median expected (preliminary) from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Source: BLS, University of Michigan via FRED and Investing.com, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko.

The current Cleveland Fed nowcast is for an increase in y/y inflation in March. Household measures (which have typically been upwardly biased before 2021) indicate elevated expected inflation through March. Still, the surveys indicate a deceleration in inflation relative to today’s levels.